Trade smarter with

AI-Driven technology

Sorry, in

Amelia is an artificial intelligence algorithm, capable of identifying strong intraday movements. These movements are associated with average growth of around 2.94% and, according to our investment system, an average return of 1.76% per operation can be obtained from this system.

Beta phase available until June 1, 2023

Note to investors

Amelia tells you where to invest 45 minutes after the market opens.

Just enter when our AI tells you to, and sell when you reach your 1% or 2% daily target.

Our AI-Technology.

Financial Intelligence

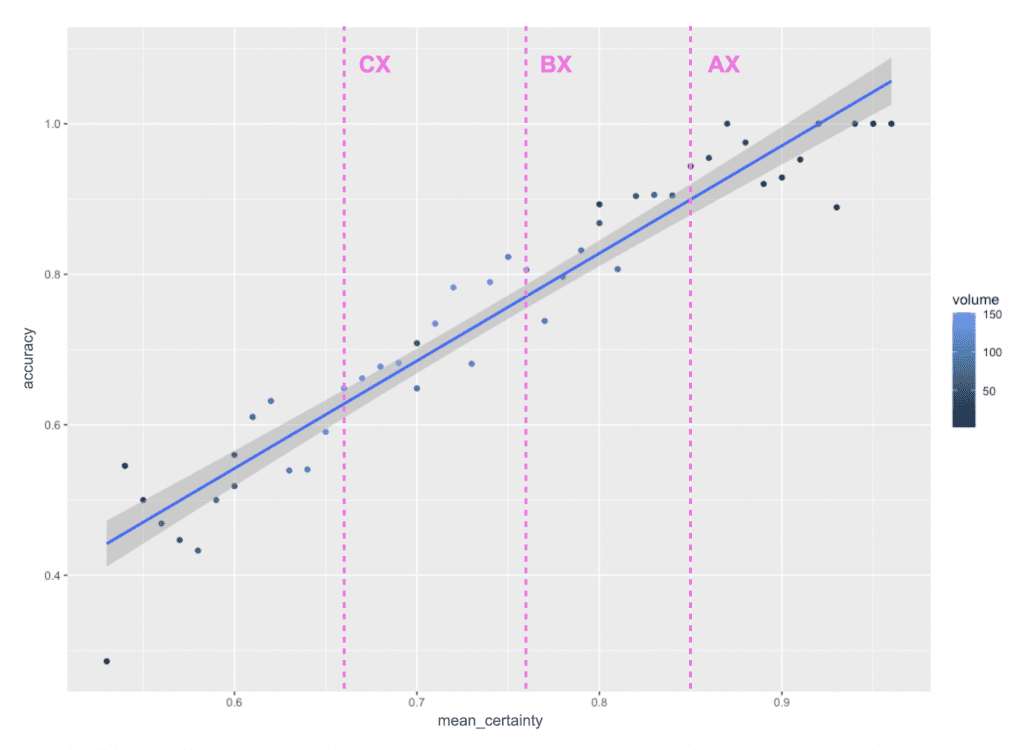

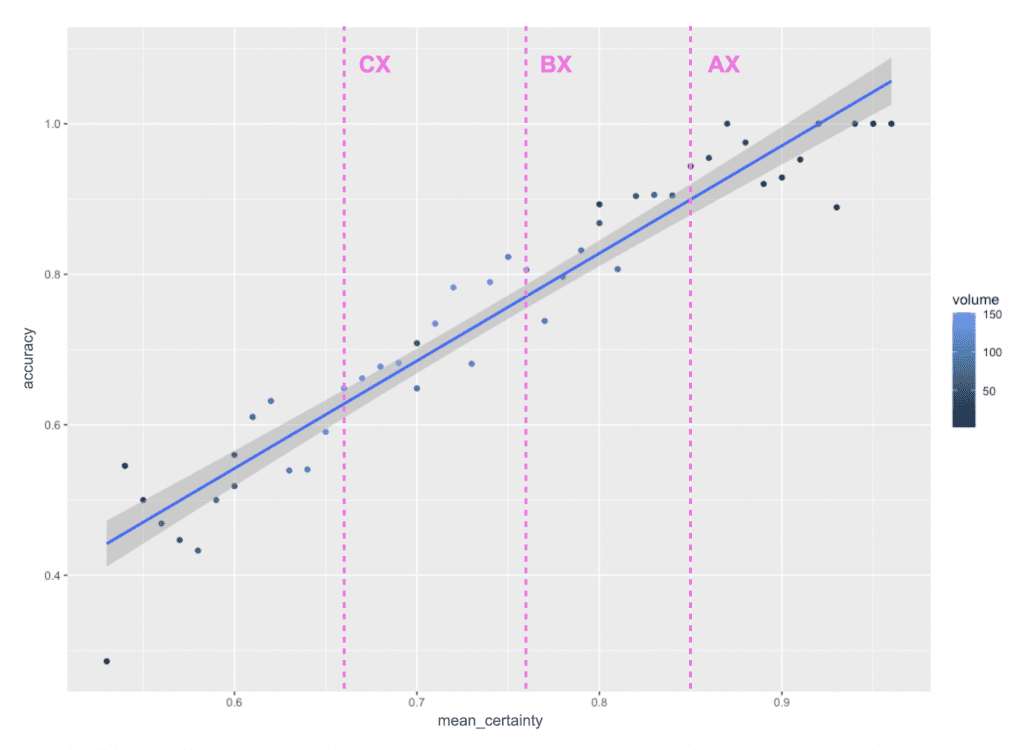

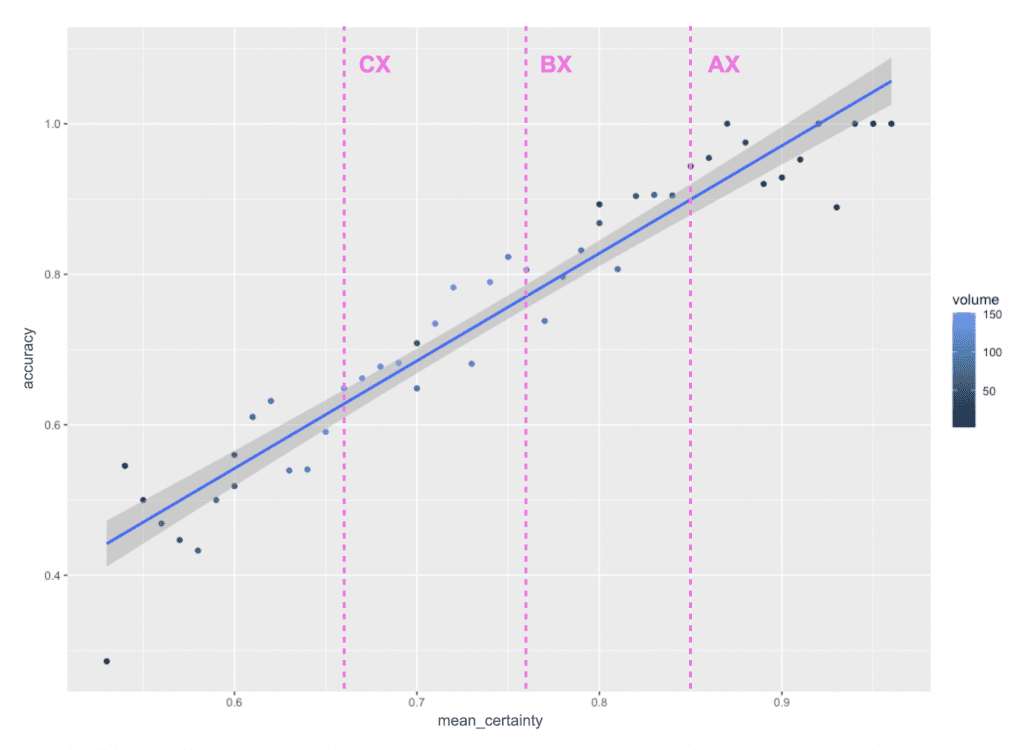

Amelia is made up of 3 own deep learning models, which we have named AM50, AM75 and AM100. These models are combined using artificial intelligence to create a higher layer: AMX Network.

The result is a combined intelligence that classifies each of the movements detected in the market according to its strength and initial momentum.

Stocks classified

by probability of growth

You choose what to invest in

We give you the classification of the stocks by their strength, based on three key elements:

- Prediction of the potential growth of the movement.

- Degree of certainty in the prediction.

- Accuracy of the prediction.

Access our 360 Pannel

Integrated with TradingView

Trained on 10 years of data

Continuously re-trained

Amelia has been trained with more than 200 million intraday movements, 3,247 variables and 10 years of data. In order to validate its potential, it has been subsequently tested with data between 2017 and 2022, in the following markets / indices:

IBEX | BME | NASDAQ | NYSE | DJIA | LSE | SEHK

What do Amelia's results mean?

Beta version only available for NASDAQ

Amelia informs you of the tickers that will grow more than 0.5% in the current day.” – from the moment of the prediction (45′ after market open)

If a ticker does not exceed 0.5%, we will show the result corresponding to the close of the day divided by the entry price (45 min after the market opens).

Example 1

The NASDAQ opens at 9:30 a.m.

If a ticker is worth $10 at 10:15 a.m., reaches $10.15 at 11:45 a.m., and then starts to fall, the result Amelia will display will be:

+1.5%

Example 2

The NASDAQ opens at 9:30 a.m.

If a ticker is worth $10 at 10:15, and reaches $10.05 at 11:45 and then starts to drop to $9.95, it will not have reached the 0.5% daily target, therefore the result that Amelia will show will be:

-0.5%

Accurate

Increase your number of operations with accurate and precise AI

Fast

Get daily results in just 10 minutes

Reliable

Contrast your analysis and opinions with our predictions.

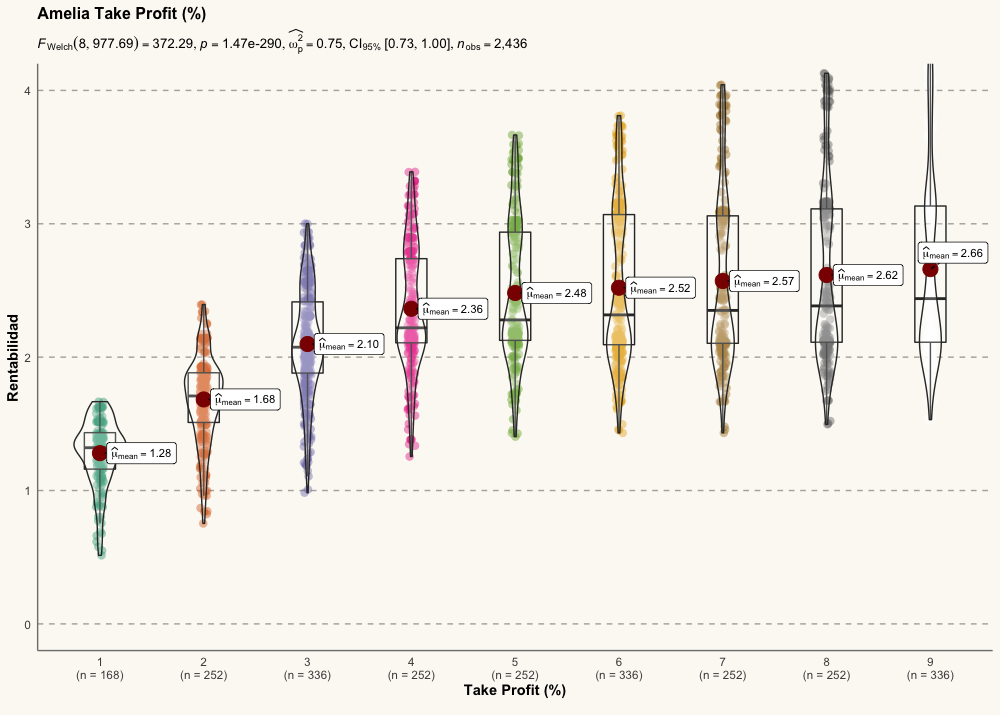

Backtesting results

Beta version only available for NASDAQ

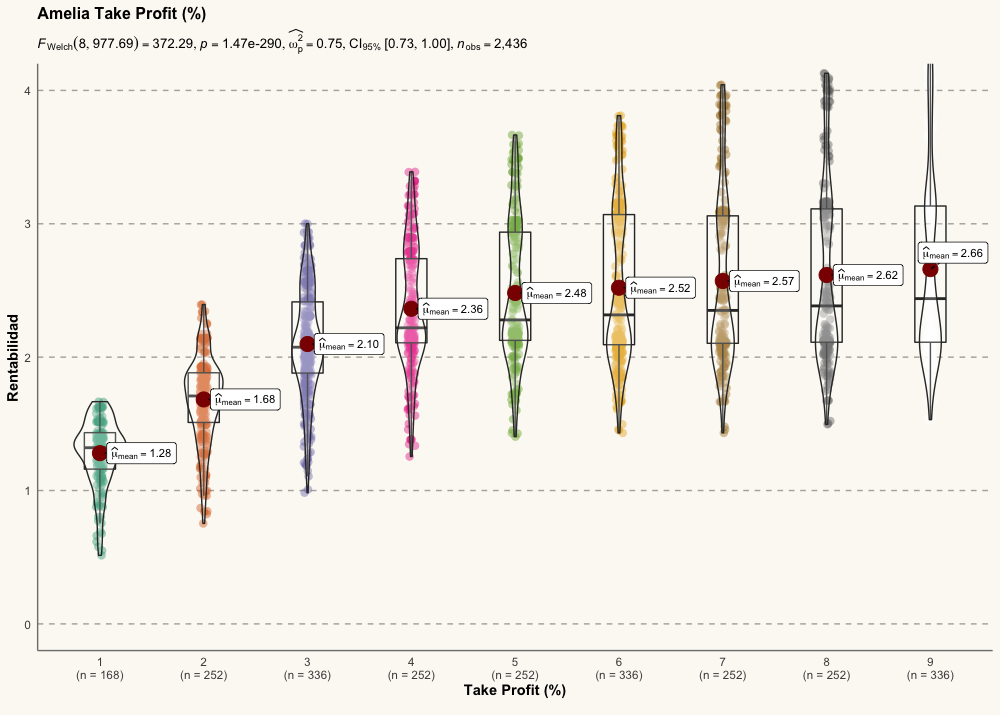

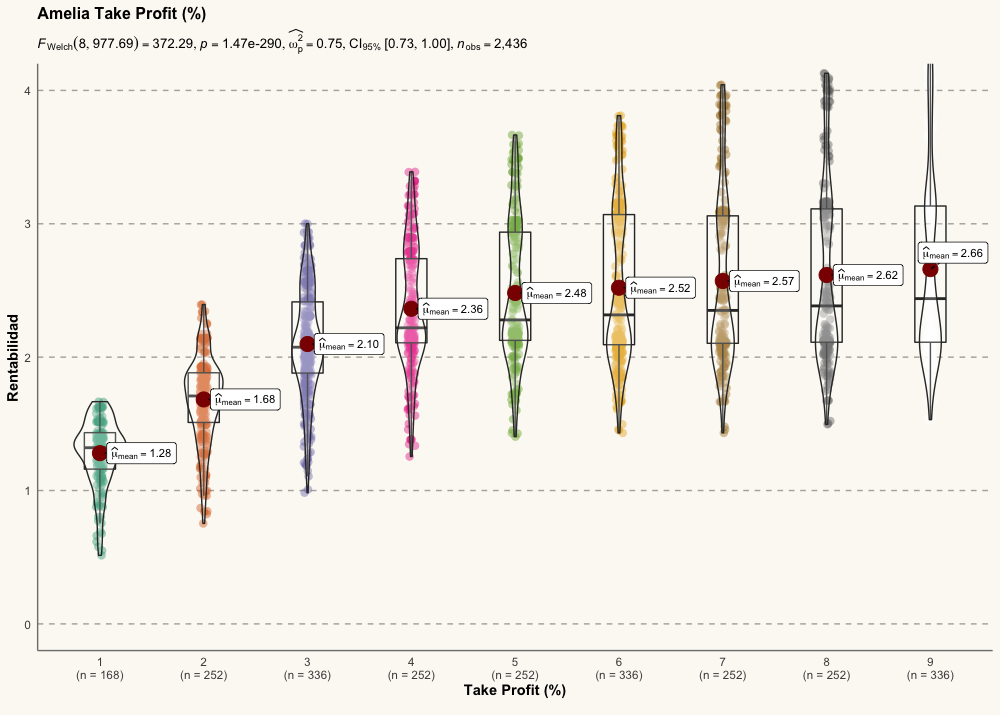

Our investment system is parameterized to take advantage of Amelia’s capabilities. It uses explicitly calculated stop-loss and take-profit thresholds and cut off values, being most suitable for each classification (AX, BX) and for each market.

As a result, the investment system generates average returns per operation of 1.76% (operating in the AX and BX classifications).

- 86% of opportunities: average return bigger than 1%.

- 67% of opportunities: average return bigger than 2%.

- 43% of opportunities: average return bigger than 3%.