Physical and computational foundations

Created by Data Scientist & Engineers

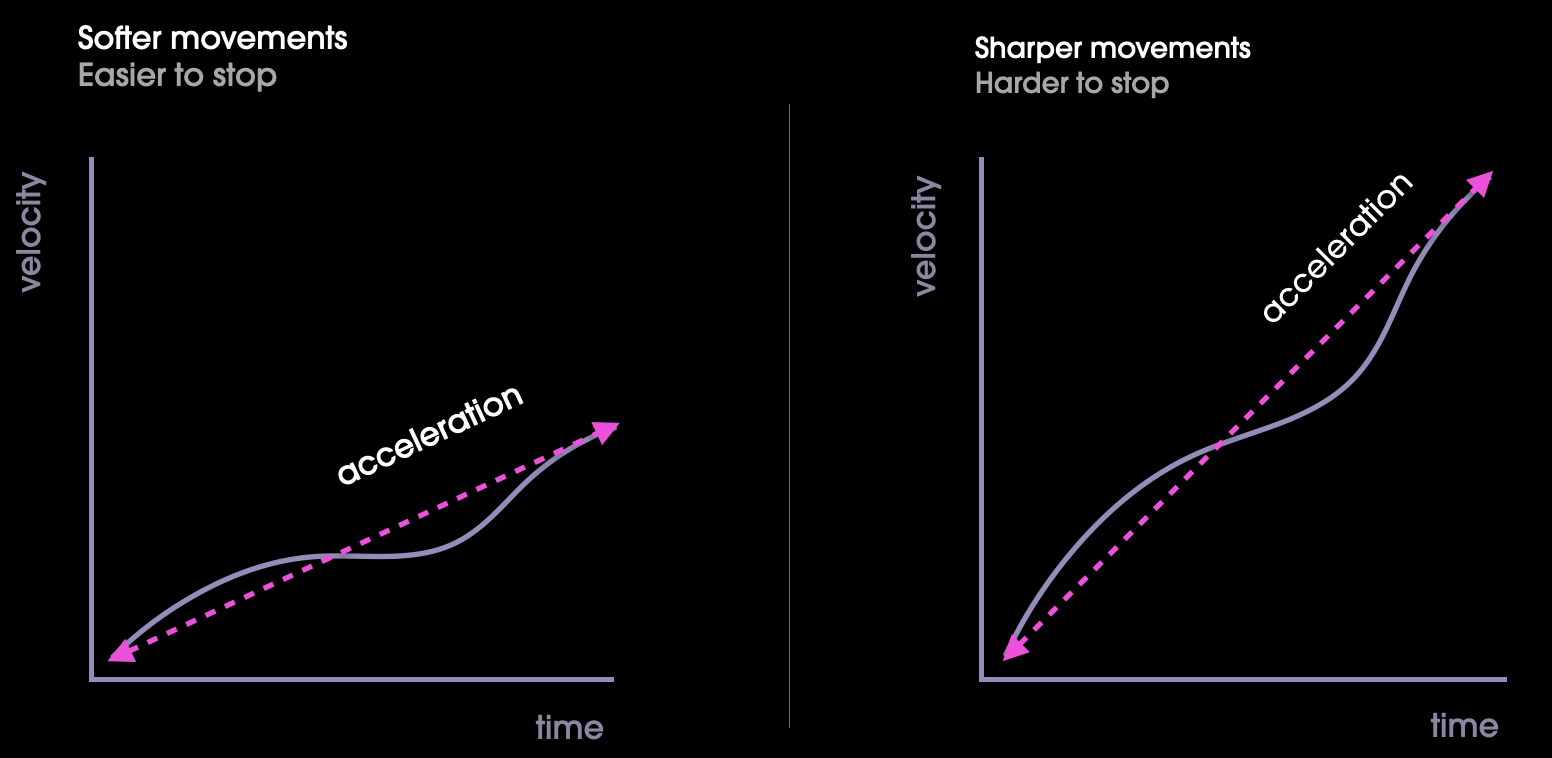

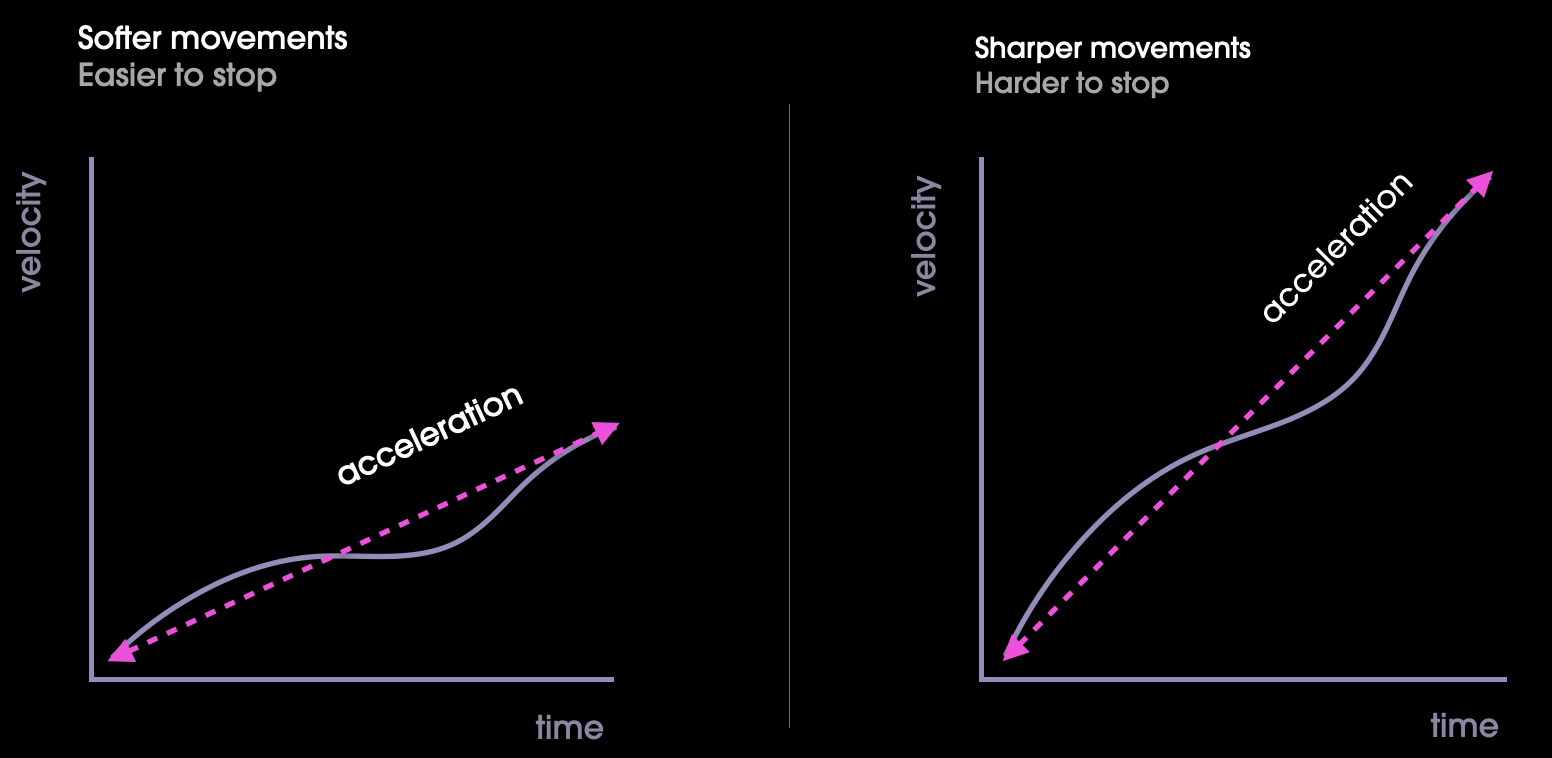

The idea behind Amelia has originated from three physical concepts: the force of a movement, its underlying acceleration, and the effort required to stop it.

Proven hypothesis

movement strength = mass * velocity

The force of a movement depends on its mass and speed, and a strong movement requires a strong counter force to stop it. An intuitive way to look at it is to think about how difficult it is to stop an oil tanker (high mass, low speed) or a bullet (low mass, high speed). These ideas of the physical world have their representation in the world of stock market movements as well.

Amelia focuses on the second type of movements, in which the movements are strong due to their speed. It detects them based on their acceleration in the early stages, the third concept we mentioned earlier. The sudden and sustained increase in speed for a certain time, alerts the initiation of a strong movement. And therefore it will take a significant force against it and a certain amount of time to stop it. That is the opportunity that Amelia takes into account: it detects the movement in its initial phase and predicts how far it will go based on its strength. Between these two moments lies the profit margins.

We search for bullets

You choose what to invest in

Because when a strong movement is launched, it requires Force and Time to go back to repose. And this Time is an opportunity if you can detect the acceleration involved in the movement in the first stages.

Amelia is especially effective at identifying sharp movements.

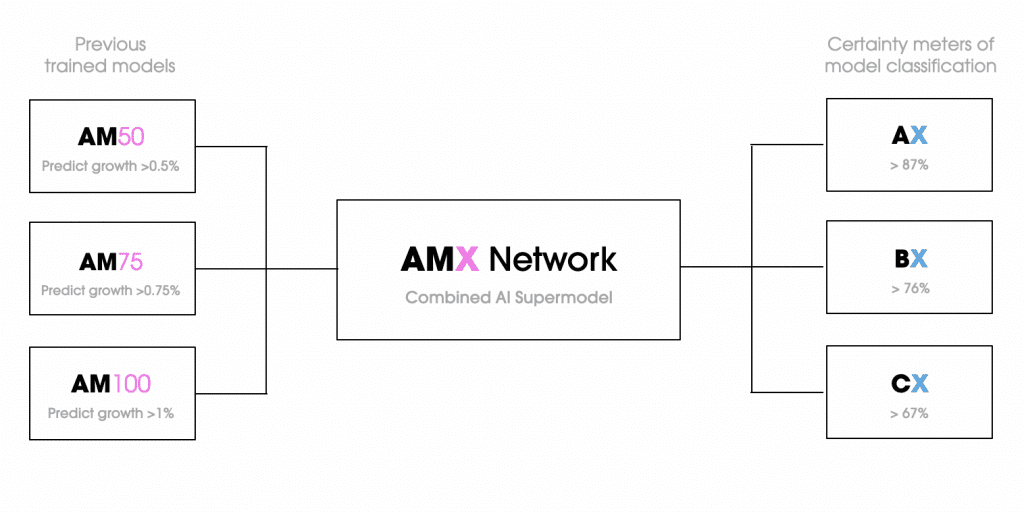

Continuously re-trained

In trends greater than 1%

Deep Learning Methods

Beta version only available for NASDAQ

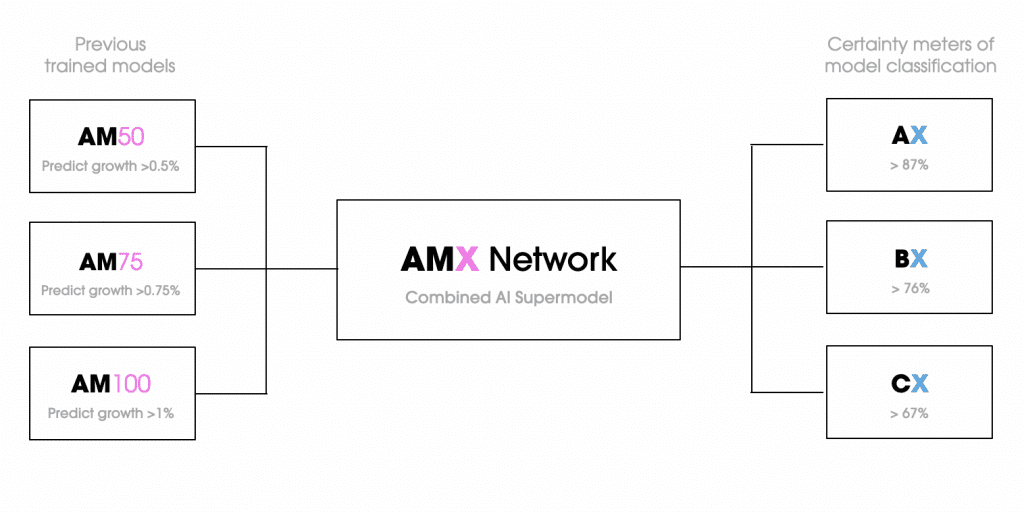

Our investment system is parameterized to take advantage of Amelia’s capabilities. It uses explicitly calculated stop-loss and take-profit thresholds and cut off values, being most suitable for each classification (AX, BX) and for each market.

As a result, the investment system generates average returns per operation of 1.76% (operating in the AX and BX classifications).

- 86% of opportunities: average return bigger than 1%.

- 67% of opportunities: average return bigger than 2%.

- 43% of opportunities: average return bigger than 3%.

What do Amelia's results mean?

Beta version only available for NASDAQ

Amelia informs you of the tickers that will grow more than 0.5% in the current day.” – from the moment of the prediction (45′ after market open)

If a ticker does not exceed 0.5%, we will show the result corresponding to the close of the day divided by the entry price (45 min after the market opens).

Example 1

The NASDAQ opens at 9:30 a.m.

If a ticker is worth $10 at 10:15 a.m., reaches $10.15 at 11:45 a.m., and then starts to fall, the result Amelia will display will be:

+1.5%

Example 2

The NASDAQ opens at 9:30 a.m.

If a ticker is worth $10 at 10:15, and reaches $10.05 at 11:45 and then starts to drop to $9.95, it will not have reached the 1% daily target, therefore the result that Amelia will show will be: